DGFT modifies Revised Import Entitlements of SION E-125 for Export of Shea Stearine, Valid till 31st March 2027

This SION will be valid till 31.03.2027 and will need to be re-assessed to reflect dynamic pricing structure of the industry.

Import Entitlements – DGFT modifies – import entitlements – Export of shea stearine – TAXSCAN

Import Entitlements – DGFT modifies – import entitlements – Export of shea stearine – TAXSCAN

The DGFT ( Directorate General of Foreign Trade ) has notified the modification in revised Import entitlements of SION E-125 for Export of Shea Stearine. The directorate issued a public notice vide no. 07/2024 dated 29th May 2024.

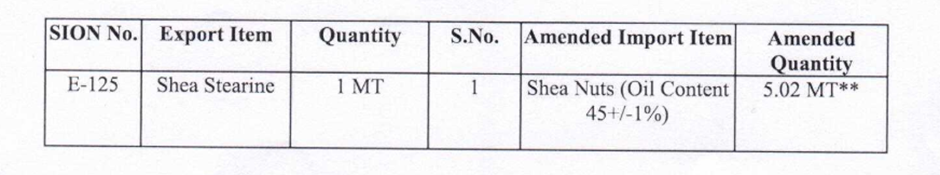

By virtue of the authority vested under Paragraph 1.03 of the Foreign Trade Policy, 2023, the Director General of Foreign Trade has enacted the following revision to SION E-125:

** For every one percent increase in the oil content beyond 46% in Shea Nut, the permitted quantity for its import may decrease by 150 kgs on pro-rata basis and for every one percent decrease in oil content below 44% in Shea Nut, the permitted quantity for its import may increase by 150 kgs on pro-rata basis.

Note I - For import item Shea Nuts, Customs Authority to draw samples for every bill of entry and test the same for its oil content. The Customs Authority to endorse on the Bill of Entry the oil content of each consignment. Regional Authority to redeem authorizations based on the weighted average of oil content so endorsed by the Customs Authority. However, clearance of import consignments should not be held back till the results are obtained, but to be allowed upon customs examination & drawing of samples.

Note 2 - This SION will be valid till 31.03.2027 and will need to be re-assessed to reflect dynamic pricing structure of the industry.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates