PAN Card update: Message Received for applying PAN through Form 49A by Income Tax Dept Responds it is Genuine

The Central government is cautioning individuals about false messages concerning refunds and customs duty payment. Following this, the Income Tax Department dispatched messages to specific taxpayers regarding the application of Permanent Account Number (PAN) or submitting PAN before the Reporting Entity and a considerable number of recipients wrongly identified these messages as fake. However, the income tax department has clarified that the message is genuine.

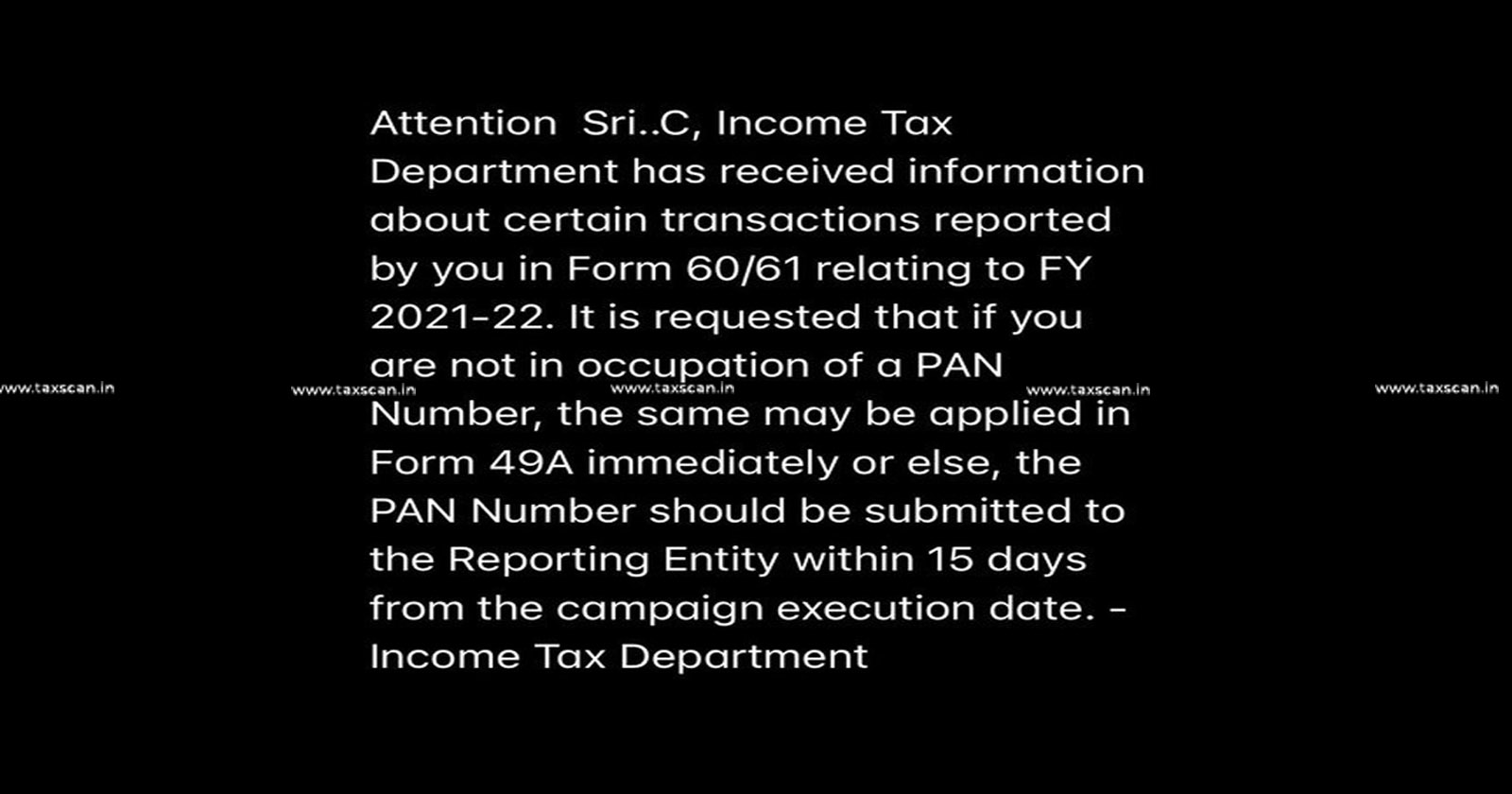

The message states that “Attention Sri…., Income Tax Department has received information about certain transactions reported by you in Form 60/61 relating to FY 2021-22. It is requested that if you are not in occupation of a PAN Number, the same may be applied in Form 49A immediately or else, the PAN Number should be submitted to the Reporting Entity within 15 days from the campaign execution date. - Income Tax Department”.

The message received was posted by many, notably Karnataka State Chartered Accountants Association. They actively participate and contribute to significant tax-related choices that are open to public input. The association has also shared the same information on Twitter

Noticing the message posted by the association, the Income Tax Department has replied that “This is a genuine SMS/Email from the Income Tax Department.”

The department also added that the “recipients of this SMS/Email may please note:

- In case you do not possess a PAN, you are requested to obtain PAN and report PAN to the Reporting Entity(RE) .

- In case you already possess a PAN, you are requested to disclose the PAN to the RE.

- RES include banks, post offices, registrars or sub-registrars of properties, etc as defined u/s 285BA of the Income-tax Act, 1961.

- For further clarification, may we request you to email your query/concerns at cmcpc_support@insight.gov.in or contact our helpdesk at 1800 103 4215.”

The message is authentic. Therefore, the individuals who haven't yet applied for a PAN or do not possess one are required to initiate the process for obtaining a new PAN by completing Form 49A. Alternatively, if you haven't already provided your PAN to the reporting entity, it's recommended to take the necessary steps to do so.

The response of the department clearly stated that if you don’t have a PAN, then apply. If you have a PAN already, then submit it before the Reporting Entities or bank where you make transactions.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates